Agon Capital, a UAE-based leading private investment and conglomerate group, has announced that 60% of its current portfolio is now allocated to lifestyle-led assets, up from 30% in 2021. The shift reflects the company’s growing focus on experience-driven investments, including hospitality, sports, and leisure, in response to changing market dynamics and investor demand across the Gulf region.

According to Agon Capital, lifestyle assets within its portfolio are achieving break-even within six months of launch, with full return on investment typically realised within 2.5 to 3 years. This performance contrasts with longer-cycle sectors such as traditional real estate, where ROI can take up to a decade. The company’s internal growth data shows a 15% revenue increase across brands such as The Coterie and Precision Football in 2024, followed by a further 10% growth in 2025.

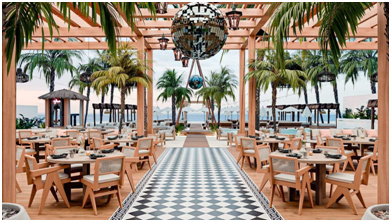

The portfolio expansion includes the launch of three lifestyle ventures over the past 18 months: Coterie Social & Kitchen, Saylor’s, BCH:CLB, and Gitano Dubai. Repeat customer engagement has been a key driver of performance, with some guests returning more than 70 times to a single venue. While lifestyle ventures demand more operational resources, including staffing and licensing, Agon Capital views them as commercially viable and scalable investments.

“We’re seeing strong demand across the region for experience-led assets that deliver measurable returns,” said Ryan Hattingh, Group CEO of Agon Capital. “These investments are no longer niche. They’re demonstrating resilience, faster ROI, and long-term brand strength, which is why we continue to grow our allocation in this segment.”

The company’s pipeline includes regional expansion of its sports platform, Precision Football, into Saudi Arabia, and the development of Villivaru Island Resort in the Maldives, a USD $300 million lifestyle investment comprising 61 villas and 11 branded residences. Scheduled to open in 2027 under a global hospitality operator, the project marks Agon’s first international expansion of its lifestyle portfolio.

External data reinforces the category’s potential. Knight Frank reports that branded residences in Dubai command up to a 35% price premium over conventional properties, while Dubai’s Department of Economy and Tourism (ADAT) values the UAE hospitality market at USD 7.37 billion in 2024, with forecasts projecting it will reach USD 9.46 billion by 2029, driven by sustained regional growth and increased private sector participation.

Agon expects lifestyle to remain a core pillar of its portfolio in the years ahead, supported by measured capital deployment and a focus on high-performing, strategically located assets.